Taxes play a crucial role in shaping the financial landscape of individuals and businesses, and understanding New York State marginal tax rates is essential for effective financial planning. Whether you're a resident of New York or planning to relocate, knowing how these rates impact your income is indispensable. This article delves deep into the complexities of New York State's tax structure, offering valuable insights and practical advice to help you navigate the tax system.

New York State is renowned for its progressive tax system, which means that as your income increases, so does the percentage of tax you pay. This approach aims to ensure that those with higher incomes contribute a fairer share to the state's revenue. Understanding the marginal tax rates is key to optimizing your tax strategy and maximizing your take-home pay.

As tax laws evolve, staying informed about the latest changes and updates is crucial. This guide not only explains the current marginal tax rates in New York but also provides historical context and projections for future changes. Whether you're a seasoned taxpayer or new to the system, this article is designed to equip you with the knowledge you need to make informed decisions.

Read also:Discover The Beauty Of Traditional Cherokee Names A Guide To Meaning And Heritage

Understanding Marginal Tax Rates

What Are Marginal Tax Rates?

Marginal tax rates refer to the rate of tax applied to each additional dollar of income earned. In New York State, the tax system is progressive, meaning that higher income levels are taxed at higher rates. This ensures that those who earn more contribute proportionally more to the state's coffers. Understanding how these rates work can help you plan your finances more effectively and take advantage of potential tax-saving opportunities.

For example, if you move into a higher tax bracket, only the income above the threshold is taxed at the higher rate, not your entire income. This is a common misconception that can lead to unnecessary financial stress. By grasping the concept of marginal tax rates, you can better manage your expectations and financial obligations.

How Marginal Tax Rates Affect Your Finances

The impact of marginal tax rates on your finances can be significant. As your income increases, so does the percentage of tax you owe. However, it's important to note that moving into a higher tax bracket does not mean all your income is taxed at the higher rate. Instead, only the portion of income that exceeds the bracket's threshold is taxed at the higher rate.

- Income below the threshold remains taxed at the lower rate.

- Only the additional income is subject to the higher rate.

- This structure allows for a more equitable distribution of tax burdens.

New York State Marginal Tax Rates Overview

Current Marginal Tax Rates

As of 2023, New York State employs a progressive tax system with several brackets. The rates range from 4% for lower-income individuals to 8.82% for the highest earners. These rates are subject to change, so it's important to stay updated with the latest tax laws and regulations.

Table of Current Marginal Tax Rates:

| Income Bracket | Tax Rate |

|---|---|

| $0 - $8,500 | 4% |

| $8,501 - $11,700 | 4.5% |

| $11,701 - $13,900 | 5.25% |

| $13,901 - $21,600 | 5.9% |

| $21,601 - $80,650 | 6.09% |

| $80,651 - $215,400 | 6.33% |

| $215,401 - $1,077,550 | 6.65% |

| $1,077,551 and above | 8.82% |

Historical Context of Tax Rates

The evolution of New York State's tax rates reflects broader economic trends and policy decisions. Over the years, the state has adjusted its tax brackets and rates to address fiscal challenges and align with federal tax policies. For instance, during economic downturns, the state may introduce temporary surcharges or adjustments to ensure revenue stability.

Read also:Hockey Fan Flashes Uncensored Understanding The Controversy And Impact

Understanding the historical context of these changes can provide valuable insights into potential future adjustments. By analyzing past trends, taxpayers can better anticipate and prepare for any upcoming changes to the tax code.

Impact of Federal Tax Laws on NY State Tax Rates

How Federal Tax Reforms Affect State Taxes

While New York State sets its own tax rates, federal tax laws can have a significant impact on state taxes. Changes at the federal level, such as the Tax Cuts and Jobs Act (TCJA) of 2017, can influence state tax policies and calculations. For example, the TCJA capped the state and local tax (SALT) deduction at $10,000, affecting many New York residents who rely on this deduction to reduce their federal tax liability.

As federal laws evolve, it's crucial for New York taxpayers to stay informed about how these changes may affect their state tax obligations. Regular updates and consultations with tax professionals can help ensure compliance and optimize tax strategies.

Strategies for Managing Marginal Tax Rates

Tax Planning Techniques

Effective tax planning is essential for managing marginal tax rates. By employing various strategies, taxpayers can minimize their tax liabilities and maximize their financial benefits. Some common techniques include:

- Utilizing tax-advantaged accounts such as IRAs and 401(k)s to defer income tax.

- Taking advantage of deductions and credits available under state and federal laws.

- Timing income and deductions to optimize tax bracket positioning.

These strategies require careful consideration and planning, often necessitating the assistance of a tax professional or financial advisor.

Consulting Tax Professionals

Given the complexity of tax laws, consulting with a tax professional can be invaluable. These experts can provide personalized advice tailored to your financial situation, helping you navigate the intricacies of New York State's tax system. They can also assist with tax preparation, ensuring that all filings are accurate and compliant with current regulations.

Common Misconceptions About Marginal Tax Rates

Addressing Misunderstandings

Many taxpayers harbor misconceptions about marginal tax rates, which can lead to poor financial decisions. One common misunderstanding is that moving into a higher tax bracket results in all income being taxed at the higher rate. This is incorrect, as only the income above the threshold is subject to the higher rate.

Another misconception is that higher tax rates always lead to reduced take-home pay. While it's true that higher rates mean more taxes, they also often come with higher incomes, which can offset the increased tax burden. Understanding these nuances can help dispel myths and lead to better financial decision-making.

Future Projections for NY State Tax Rates

Predicting Tax Rate Changes

Looking ahead, New York State may continue to adjust its tax rates in response to economic conditions and legislative priorities. Factors such as budget deficits, federal tax reforms, and changing demographics can influence these decisions. Taxpayers should remain vigilant and informed about potential changes that could impact their financial planning.

While predicting exact changes is challenging, historical trends and current economic indicators can provide some guidance. By staying informed and proactive, taxpayers can better prepare for any shifts in the tax landscape.

Comparing NY State Tax Rates with Other States

State-by-State Tax Analysis

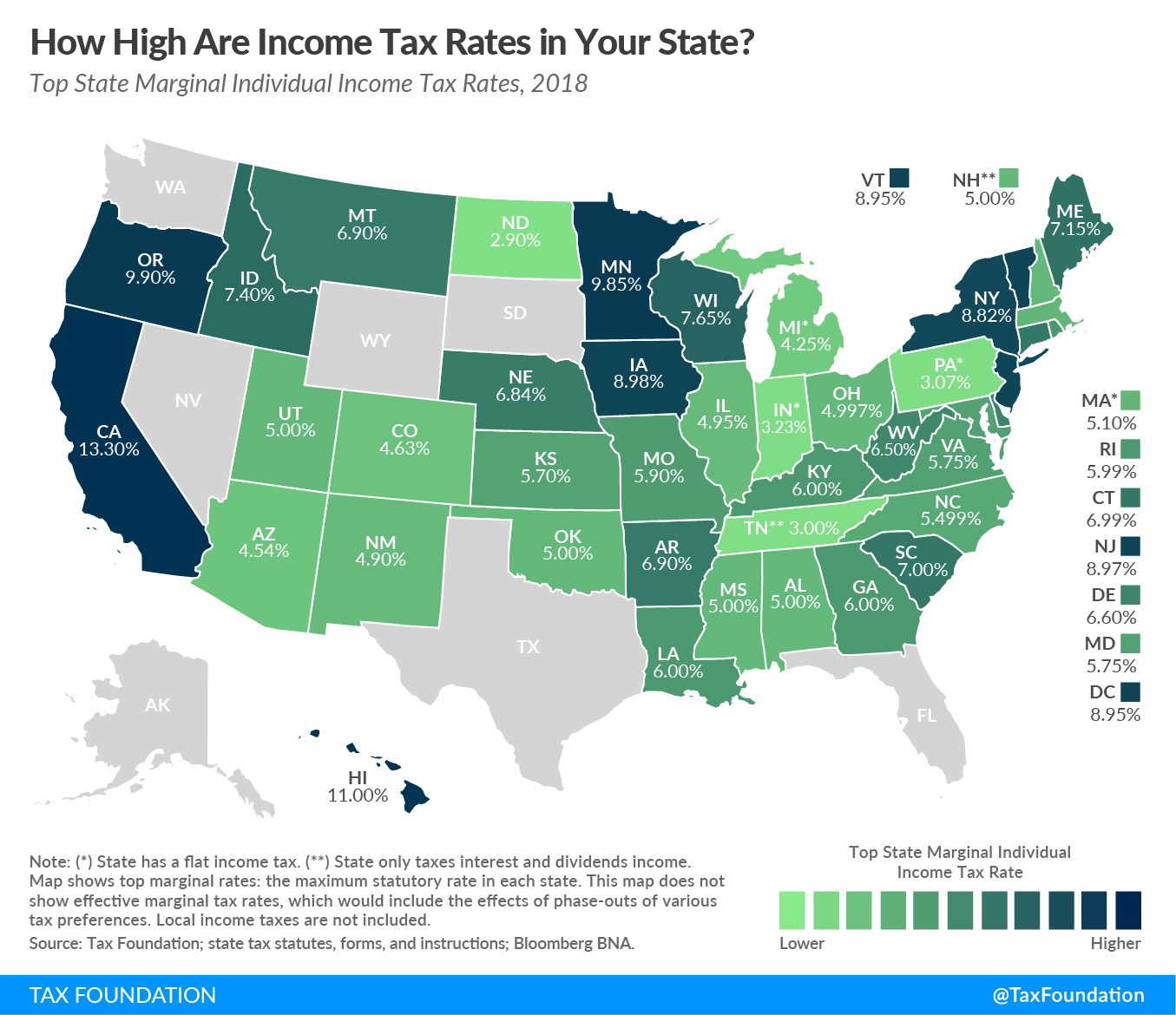

New York State's tax rates are among the highest in the nation, reflecting the state's commitment to funding public services and infrastructure. However, when compared to other states, the overall tax burden can vary significantly. Some states, like Florida and Texas, have no state income tax, making them attractive options for retirees and businesses.

Understanding how New York's tax rates compare to those of other states can help taxpayers make informed decisions about relocation, investment, and financial planning. It's important to consider not only income tax but also property taxes, sales taxes, and other state-specific levies when evaluating overall tax burdens.

Resources for Understanding NY State Tax Rates

Official State Resources

The New York State Department of Taxation and Finance provides a wealth of information for taxpayers seeking to understand the state's tax system. Their website offers detailed guides, calculators, and forms to assist with tax preparation and compliance. Additionally, they provide updates on any changes to tax laws and regulations, ensuring that taxpayers remain informed.

For those seeking more personalized assistance, the department offers phone and in-person support, as well as resources for small businesses and non-profits. These resources can be invaluable for navigating the complexities of New York State's tax code.

Conclusion

In conclusion, understanding New York State marginal tax rates is essential for effective financial planning. By grasping the concept of marginal tax rates, staying informed about current rates and potential changes, and employing strategic tax planning techniques, taxpayers can optimize their financial outcomes. Remember to consult with tax professionals when necessary and utilize available resources to ensure compliance and maximize benefits.

We invite you to share your thoughts and experiences in the comments below. Your feedback is invaluable to us and helps us improve our content. Additionally, feel free to explore our other articles for more insights into personal finance and tax strategies. Together, let's navigate the complexities of taxation and build a more secure financial future.

Table of Contents

- Understanding Marginal Tax Rates

- Current Marginal Tax Rates

- Historical Context of Tax Rates

- Impact of Federal Tax Laws on NY State Tax Rates

- Strategies for Managing Marginal Tax Rates

- Common Misconceptions About Marginal Tax Rates

- Future Projections for NY State Tax Rates

- Comparing NY State Tax Rates with Other States

- Resources for Understanding NY State Tax Rates

- Conclusion