Understanding New York State marginal tax rates is crucial for both residents and businesses to ensure proper financial planning and compliance with tax regulations. Whether you're an individual taxpayer or a business owner, knowing how these rates work can significantly impact your financial decisions. Marginal tax rates play a pivotal role in shaping the tax burden for individuals and businesses, particularly in a state like New York, which has one of the highest tax rates in the country.

New York State marginal tax rates are designed to ensure that taxpayers contribute proportionally based on their income levels. This progressive tax system aims to create a fair distribution of tax responsibility across different income brackets. In this article, we will delve into the intricacies of New York State's tax structure, providing you with detailed insights and actionable advice to help you navigate this complex system.

This guide will not only explain the current tax rates but also provide historical context, projections for the future, and practical strategies for optimizing your tax planning. Whether you're a seasoned tax professional or a newcomer to the world of taxation, this article aims to equip you with the knowledge you need to make informed decisions.

Read also:Marie Osmond Passed Away Remembering The Iconic Singer And Entertainer

Understanding Marginal Tax Rates in New York State

Marginal tax rates in New York State refer to the tax rate applied to each additional dollar of income earned. Unlike a flat tax rate, which applies the same percentage to all income levels, the marginal tax system divides income into brackets, each with its own tax rate. This ensures that higher earners contribute a larger percentage of their income to taxes, while lower-income individuals pay a smaller percentage.

How Marginal Tax Rates Work

To fully grasp the concept of marginal tax rates, it's important to understand how they are applied. Each income bracket is taxed at a specific rate, and as income increases, the additional income falls into higher brackets. For instance, if the first $10,000 of income is taxed at 4%, and the next $20,000 is taxed at 6%, only the income above $10,000 is taxed at the higher rate.

- Income up to $10,000 is taxed at 4%.

- Income between $10,001 and $30,000 is taxed at 6%.

- Higher brackets follow the same principle.

New York State Tax Brackets and Rates

The New York State tax brackets are regularly updated to reflect changes in the cost of living and economic conditions. Below is a breakdown of the current tax brackets and their corresponding rates:

2023 Tax Brackets for Single Filers

For single filers in 2023, the tax brackets are as follows:

- Income up to $8,500 is taxed at 4%.

- Income between $8,501 and $11,700 is taxed at 4.5%.

- Income between $11,701 and $13,900 is taxed at 5.25%.

- Higher brackets continue with increasing rates.

2023 Tax Brackets for Married Filers

Married couples filing jointly have slightly different brackets:

- Income up to $17,100 is taxed at 4%.

- Income between $17,101 and $23,400 is taxed at 4.5%.

- Income between $23,401 and $27,800 is taxed at 5.25%.

- Higher brackets follow a similar pattern.

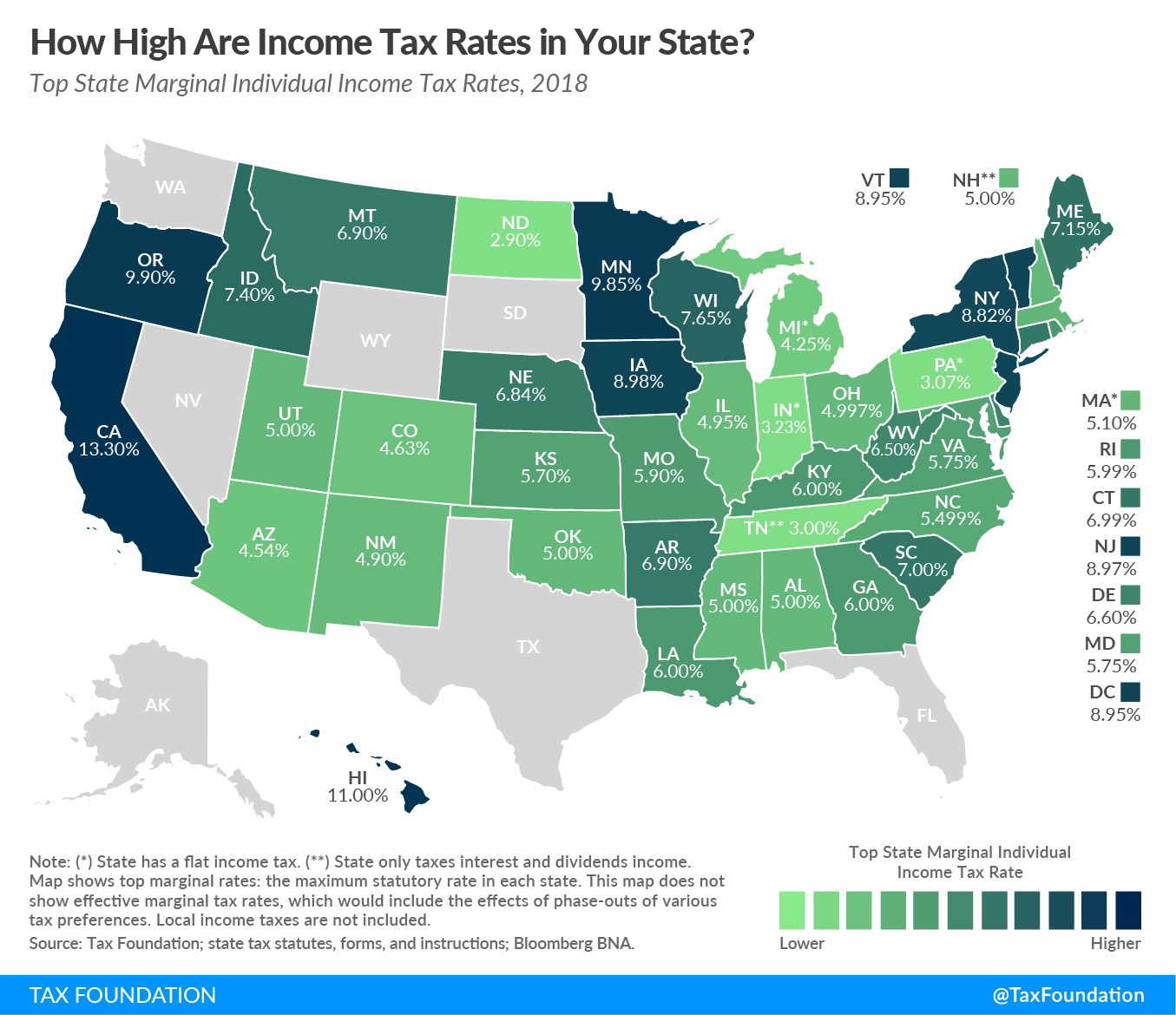

Historical Context of New York State Tax Rates

New York State's tax rates have evolved significantly over the years. Initially introduced as a flat tax system, the state transitioned to a progressive system in the mid-20th century. This change was driven by the need to address growing income inequality and fund public services. Over the decades, the tax brackets and rates have been adjusted multiple times to reflect economic changes and policy priorities.

Read also:Forrest Frank Weathering The Storm On A Good Day

Key Changes in Recent Years

In recent years, New York State has implemented several significant changes to its tax structure:

- Increase in top marginal tax rates for high-income earners.

- Introduction of temporary surcharges during economic downturns.

- Adjustments to brackets to account for inflation.

Impact of Marginal Tax Rates on Individuals

For individuals, understanding marginal tax rates is essential for effective financial planning. These rates directly impact disposable income, savings, and investment decisions. By knowing how much additional income will be taxed, individuals can make informed choices about employment, investments, and retirement planning.

Tips for Optimizing Your Taxes

Here are some strategies individuals can use to optimize their taxes:

- Take advantage of tax deductions and credits.

- Consider timing income and deductions strategically.

- Consult a tax professional for personalized advice.

Impact of Marginal Tax Rates on Businesses

Businesses operating in New York State are also subject to marginal tax rates, which can influence their financial strategies and profitability. Understanding these rates helps businesses plan for expenses, allocate resources, and make investment decisions.

Strategies for Businesses

Businesses can employ the following strategies to manage their tax burden:

- Utilize available tax incentives and credits.

- Optimize business structure to minimize taxes.

- Invest in employee benefits that are tax-deductible.

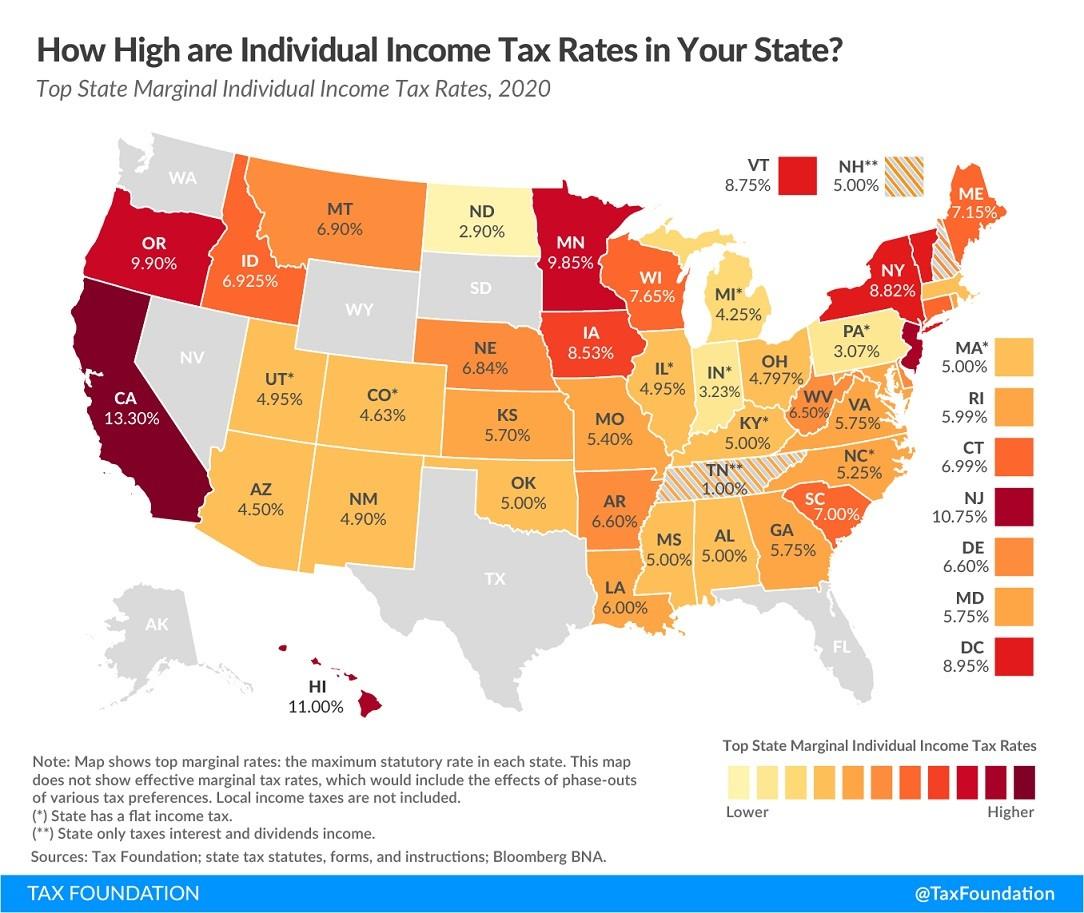

Comparison with Other States

New York State's marginal tax rates are among the highest in the United States. Comparing these rates with other states provides valuable context for both residents and businesses considering relocation or expansion. States like Florida and Texas, which have no state income tax, offer stark contrasts to New York's progressive system.

Key Differences

Key differences between New York and other states include:

- Higher top marginal rates in New York.

- More brackets and complexity in New York's system.

- Availability of tax incentives in competing states.

Future Projections for New York State Tax Rates

Looking ahead, New York State's tax rates are likely to remain a topic of debate and discussion. Economic conditions, federal policies, and demographic shifts will all play a role in shaping future tax reforms. While predicting exact changes is difficult, trends suggest continued focus on fairness and revenue generation.

Potential Changes

Some potential changes to watch for include:

- Adjustments to brackets to address inflation.

- Introduction of new tax incentives for specific industries.

- Reevaluation of surcharges during economic challenges.

Practical Steps for Tax Planning

Effective tax planning is essential for both individuals and businesses. By staying informed about New York State marginal tax rates and leveraging available resources, you can minimize your tax burden and maximize your financial health.

Resources for Tax Planning

Here are some resources to assist with tax planning:

- New York State Department of Taxation and Finance website.

- IRS publications and guidelines.

- Professional tax advisory services.

Conclusion

In conclusion, understanding New York State marginal tax rates is vital for anyone seeking to navigate the complexities of taxation in the state. By familiarizing yourself with the current rates, historical context, and potential future changes, you can make informed decisions that benefit your financial well-being. We encourage you to take action by reviewing your tax situation, consulting professionals, and exploring available resources.

Feel free to leave a comment or share this article with others who may find it useful. For more insights into financial planning and taxation, explore our other articles and resources. Together, we can help you achieve your financial goals and thrive in an ever-changing economic landscape.

Table of Contents

- Understanding Marginal Tax Rates in New York State

- New York State Tax Brackets and Rates

- Historical Context of New York State Tax Rates

- Impact of Marginal Tax Rates on Individuals

- Impact of Marginal Tax Rates on Businesses

- Comparison with Other States

- Future Projections for New York State Tax Rates

- Practical Steps for Tax Planning

- Conclusion