The 1099-G form is an essential document for individuals who received certain types of government payments during the tax year. Whether you're a freelancer, contractor, or someone who received unemployment benefits, understanding this form is crucial for accurate tax filing. This guide will provide you with a detailed overview of the 1099-G form, its importance, and how it impacts your tax obligations.

As tax season approaches, many individuals find themselves overwhelmed by the multitude of forms they need to complete. Among these forms, the 1099-G stands out as particularly important for those who received government payments. This form reports various types of income, including unemployment compensation, state or local income tax refunds, and other government payments.

This article aims to simplify the complexities surrounding the 1099-G form, offering actionable insights and expert advice to help you navigate the tax filing process with confidence. Whether you're filing your taxes independently or working with a professional, having a clear understanding of this form is essential.

Read also:Camilla Xaraujo Unveiling The Rising Star Of Modern Entertainment

What is a 1099-G Form?

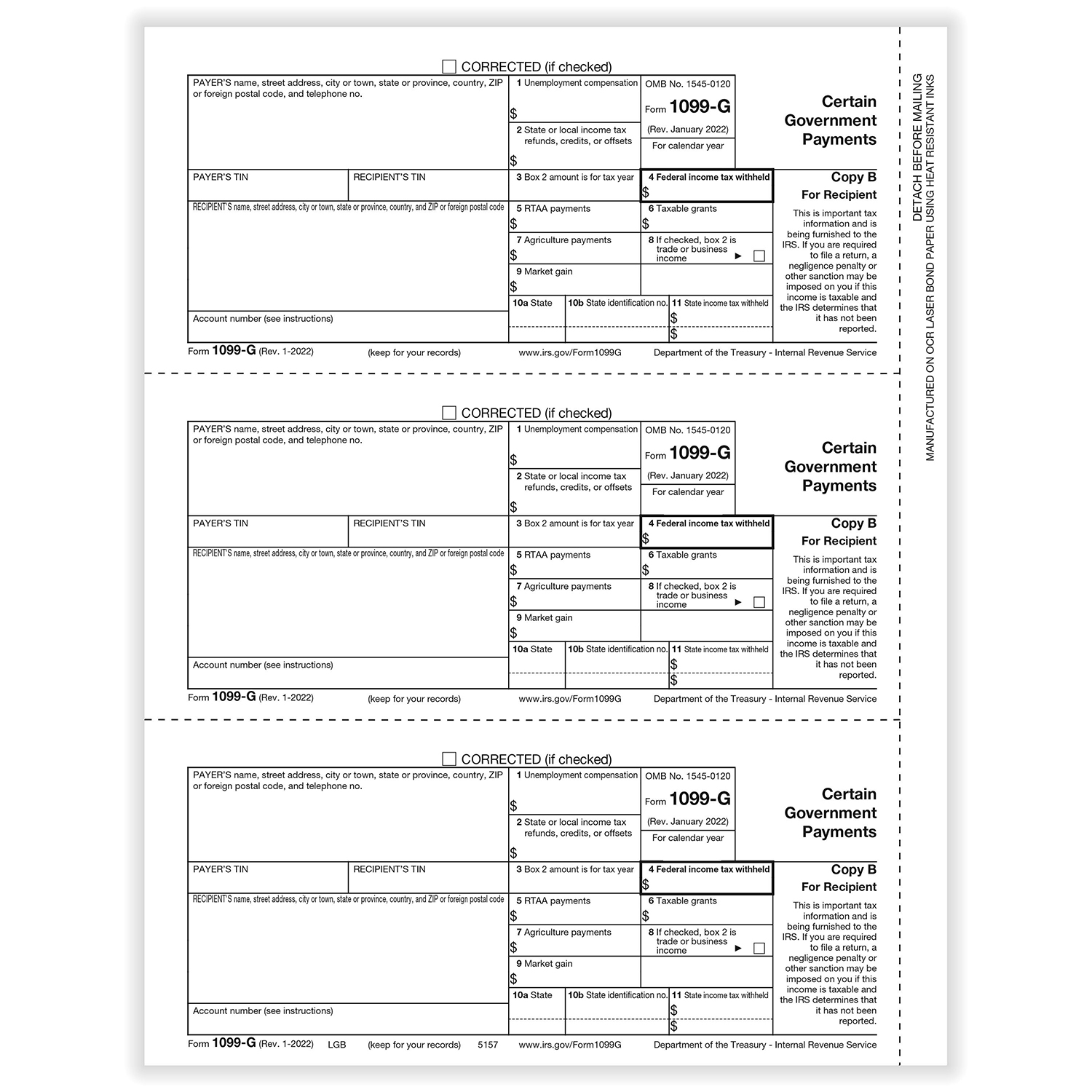

The 1099-G form is an IRS document issued to individuals who received payments from government entities during the tax year. These payments may include unemployment compensation, state or local tax refunds, and other government-related income. The form is used to report these payments to the IRS, ensuring that taxpayers accurately report their income on their tax returns.

Key Features of the 1099-G Form

- Reports government payments received during the tax year.

- Used by individuals to file accurate tax returns.

- Includes important information such as unemployment compensation and tax refunds.

Why is the 1099-G Form Important?

The 1099-G form plays a critical role in the tax filing process by ensuring that all government payments are accurately reported. Failing to include this information on your tax return could result in underreporting your income, leading to potential penalties or audits. Understanding the purpose and importance of this form is vital for maintaining compliance with IRS regulations.

Consequences of Ignoring the 1099-G Form

- Potential underpayment of taxes.

- Increased risk of IRS audits.

- Fines and penalties for non-compliance.

Who Receives the 1099-G Form?

Not everyone will receive a 1099-G form. It is typically issued to individuals who have received certain types of government payments, such as unemployment benefits, state tax refunds, or other government-related income. If you fall into any of these categories, it's important to be aware of the form and its implications for your tax return.

Types of Payments Reported on the 1099-G Form

- Unemployment compensation.

- State or local income tax refunds.

- Other government payments, such as grants or awards.

How to Complete the 1099-G Form

Completing the 1099-G form requires careful attention to detail. The form includes various boxes that report different types of payments, and it's essential to ensure that all information is accurate and up-to-date. By following these steps, you can complete the form with confidence:

Steps to Fill Out the 1099-G Form

- Verify your personal information, including your Social Security Number (SSN).

- Review the boxes that apply to your situation, such as unemployment compensation or tax refunds.

- Double-check all figures to ensure accuracy.

Understanding the Boxes on the 1099-G Form

The 1099-G form includes several boxes, each reporting a specific type of payment. Familiarizing yourself with these boxes will help you better understand the information being reported:

Common Boxes on the 1099-G Form

- Box 1: Unemployment compensation.

- Box 2: State or local income tax refunds.

- Box 3: Other specified payments.

Tax Implications of the 1099-G Form

Receiving a 1099-G form can have significant tax implications. Depending on the type of payment reported, you may be required to include this income on your tax return. Understanding how these payments affect your tax liability is crucial for accurate reporting.

Read also:Kemuri Heku The Hidden Gem Of Japanese Culinary Art

How Unemployment Compensation Affects Your Taxes

- Unemployment benefits are generally considered taxable income.

- Failure to account for these benefits could result in underpayment of taxes.

Common Mistakes to Avoid with the 1099-G Form

When working with the 1099-G form, it's important to avoid common mistakes that could lead to errors on your tax return. These mistakes can result in penalties or audits, so it's essential to be vigilant:

Mistakes to Watch Out For

- Forgetting to include all reported payments on your tax return.

- Miscalculating the total amount of income reported.

- Ignoring the form altogether.

Where to Get Help with the 1099-G Form

If you're unsure about how to handle the 1099-G form, there are several resources available to assist you. Consulting a tax professional or utilizing IRS resources can provide the guidance you need to file your taxes accurately:

Resources for Assistance

- IRS website for official guidance.

- Professional tax advisors for personalized advice.

Conclusion: Mastering the 1099-G Form for Tax Success

In conclusion, the 1099-G form is a critical component of the tax filing process for many individuals. By understanding its purpose, importance, and how it impacts your tax obligations, you can ensure accurate reporting and compliance with IRS regulations. Remember to:

- Review all information on the form carefully.

- Include all reported payments on your tax return.

- Seek professional assistance if needed.

We encourage you to share this article with others who may benefit from its insights. Additionally, feel free to leave comments or questions below, and don't hesitate to explore other articles on our site for more tax-related information.

Table of Contents

- What is a 1099-G Form?

- Why is the 1099-G Form Important?

- Who Receives the 1099-G Form?

- How to Complete the 1099-G Form

- Understanding the Boxes on the 1099-G Form

- Tax Implications of the 1099-G Form

- Common Mistakes to Avoid with the 1099-G Form

- Where to Get Help with the 1099-G Form

- Conclusion: Mastering the 1099-G Form for Tax Success